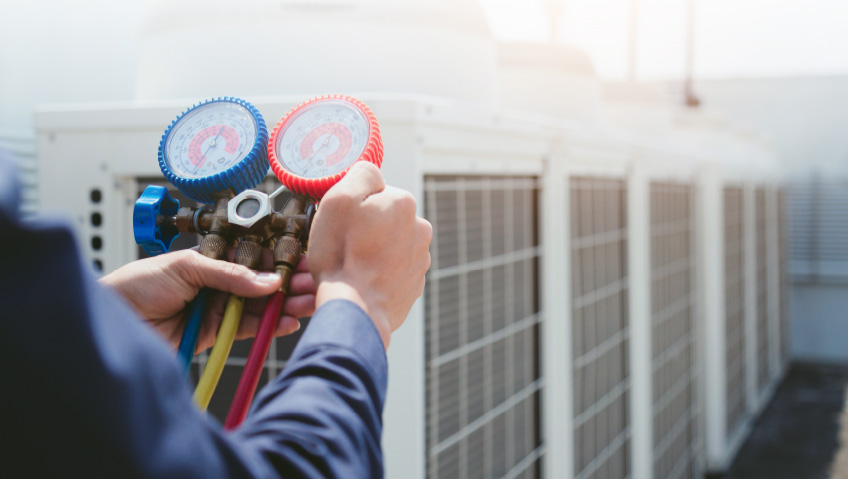

TurnPoint Services delivers residential and commercial heating, ventilation, air conditioning (HVAC), plumbing, power, and electrical services. The Louisville, Kentucky-based business also boasts a sizable construction division focused on plumbing construction and HVAC construction, primarily for the residential and multifamily markets.

The company launched in 2016 when Dauenhauer Plumbing was acquired by Trivest Partners, a Miami-based, lower-middle-market private equity firm. “From those humble beginnings, we have implemented a buy-and-build strategy supported by our financial sponsors,” says Chief Executive Officer Kurt Bratton.

An out-of-the-box mentality has set the company apart throughout its growth. “Our mindset and approach are much different than others in the space starting with building a leadership team that, for the most part, came from outside the industry,” says Chief Strategy Officer Curtis Bragg. “Those ‘non-industry’ experiences position us to really respect the technical expertise and people present at the brand level and provide world-class approaches to building a durable company.”

This unique tactic has yielded remarkable results. Since its founding, the business has acquired fifty-seven companies, grown from around $30 million in revenue to about $1.4 billion since 2016, and has legacy brands operating in approximately fifty markets throughout the United States, across thirty-four states.

The industry has been moving toward consolidation for several decades, and the trend continues to gain momentum. “The investment community, as well as these family-owned businesses, has reached a point of maturity and sophistication in terms of technology and training,” Bratton says. “It has proven to be a very resilient business, and it’s an excellent way for family businesses to ensure that their legacy lives on.”

The nature of the service industry makes consolidation particularly advantageous. “Many industries with a local customer set are, by their nature, highly fragmented and have developed that way over time,” says Chief Development Officer Stephen Saunders.

“Part of the reason for that fragmentation is the very low barrier to entry. Take the example of a plumber. A guy with a wrench, a truck and a license—some even without a license—can go be a plumber. So all of the trades, especially those focused on individual residential customers, are highly fragmented and have been for many, many years. What we have seen in our industry, like a lot of others, are companies with capital coming in and beginning to consolidate by buying up leading local service providers and beginning to bring them together,” he adds.

“Some of the advantages of consolidating are pure and simple, like efficiencies of scale,” Saunders says. “TurnPoint and companies like TurnPoint are able to buy things in larger volume, whether that is HVAC equipment, employee health insurance, or business insurance. So, as a result, that reduces your costs and, therefore, makes you more competitive in a local market,” he explains.

“Another economy of scale is simply capital and working capital,” he continues. “Individual owners typically don’t have access to large bank loans or large lending facilities, but we do because we’re a very large company, and we have sophisticated private equity investors who have relationships with large banks. So when you begin to cobble together a number of small businesses to form a large business, you get that scale. You can borrow money more cheaply and use that money to grow faster by buying things like trucks and hiring more technicians. Those are some of the economies of scale that really help accelerate growth and profitability.”

Another clear benefit of consolidation is that it facilitates best practices. “If you put together fifty-seven businesses like we have that all do the same thing in separate locations, it’s very natural that you’re going to start to notice trends and notice that certain businesses do things much more effectively than others,” says Saunders.

“So you can take the best practice from some of those businesses and introduce them to the others, so that, collectively, you become stronger and more agile. The end goal and the intended product is that, when you pull together a large number of businesses in a very fragmented industry, it creates a stronger whole. It puts you in a stronger competitive position and allows you to take market share within each of the markets in which your business is competing,” he points out.

TurnPoint Services has stepped up to lead the industry on consolidation. “TurnPoint Services has been the most active acquirer in the industry over the last four years or so,” says Bratton. The result is mutually beneficial for both parties.

“We set out to create a unique ecosystem for small family—and entrepreneurial—businesses, and we operate more on principles than on policies,” he explains. “We focus on freedom within a framework. The businesses who join us have a chance to continue to grow and still provide local leadership and local control over culture, growth plans, identity, and brand—those key elements that make those businesses so special in the local community. At the same time, we are providing a suite of capabilities and services to enable growth that finds its way in terms of technology, marketing, business intelligence, fleet services, and the back-office processes that support and enable outsize growth.”

Treating people well is another straightforward, yet important, factor that helps close the deal. “We treat people as we would want to be treated,” Saunders says. “Following the basic golden rule is a starting point that seems very simple, but a lot of people don’t follow the golden rule, and that opens some space for us to do that and gain from it.”

This commitment to honesty sets TurnPoint Services apart. “Another simple part of trying to follow the golden rule is doing what we say we’re going to do,” he says. “It’s very common in the acquisition landscape at large, and unfortunately, private-equity-backed companies often get a reputation for retracting—coming in, playing the bait-and-switch game, telling you they’re going to pay more than they actually plan to. We don’t do that. We pride ourselves and stand very firm upon doing what we say we’re going to do when it comes to interactions with sellers. When we send a business owner a letter of intent to acquire his or her company, we want our reputation to be such that they know they can count on that letter. They’re not going to receive a letter that promises something we can’t deliver on. We want them to feel confident and comfortable that we’re going to do what we say we’re going to do. It just comes down to basic trust and setting the expectation and building a reputation.”

As a result, TurnPoint Services has earned a respected position in the industry. “We know anecdotally that it has worked,” Saunders says. “There are some advisors who work with a number of sellers out there that will very quickly tell their clients that TurnPoint’s letter of intent is the gold standard, and we will follow through on our promises. When you’re competing against other buyers who don’t always do what they say they’re going to do, that makes a big difference.”

With so much to offer, it is no surprise that potential deals keep coming in. “When you combine the reputation that we’ve built in being a company that does everything that we say we’re going to do and is fair dealing, along with our success as a company, I think that it creates an atmosphere where people are at least willing to give us a look,” Bratton says. “And if it feels right to the family business or the entrepreneur and it feels right to us, we’re able to get these deals done pretty quickly.”

Technology is yet another area in which TurnPoint excels, going so far as to develop its proprietary artificial intelligence (AI). “We made a commitment early on to leverage technology wherever possible throughout our company to generate the best experiences for customers and employees or to fuel better business performance,” Bragg says. “It was that commitment and desire to excavate deeper insights from consumers, and apply this intelligence faster and more precisely to drive action across the organization, that led to exploring the use of AI. For example, applying AI to our call centers opened the door to customer sentiment analysis to identify instances of negative or positive customer emotions and silence detection. We use these and other insights to coach our people and improve consumer interactions.”

TurnPoint also set out to solve the challenge of predicting consumer demand that led to creating its very own proprietary AI tool.

Although in its early stages of development, early results have shown the ability to predict consumer demand up to a week in advance with 95 percent accuracy. “It’s quite a remarkable technology whose pay-off, particularly during peak seasons, is in scheduling, customer experience, and work-life balance for our technicians,” he adds.

After accomplishing so much in such a short time, the team is eager to keep moving forward. “TurnPoint will continue to be opportunistic and invite great family businesses across America to join the family,” Bratton says. “But we’ll also be heavily focused on our organic growth profile and investing in our people.”

The goal is to at least double the size of the company over the next five years. Already well on its way to achieving this goal, TurnPoint Services will be one to watch in the years to come.